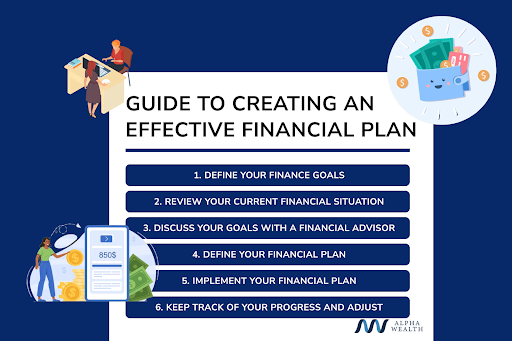

At Alpha Wealth, we understand that managing your personal finances can be a daunting task. However, creating a financial plan is a vital step in taking control of your finances. An effective financial plan allows you to identify areas for improvement to effectively manage your finances and ensure financial stability for your future. In this blog post, our financial advisor breaks down the six simple steps on how to create a financial plan that will set you up for financial freedom.

- 1. Define Your Financial Goals

- 2. Review Your Current Financial Situation

- 3. Discuss Your Goals with a Financial Advisor

- 4. Define Your Financial Plan

- 5. Implement Your Financial Plan

- 6. Keep Track of Your Progress and Adjust

Define Financial Goals

Financial goals act as the base for any financial plan. To know what to plan for, you must determine your personal financial goals. You can start by identifying what exactly you want to accomplish with your money.

This can be anything from:

- Putting a down payment on a house

- Starting a business,

- Planning for your families futures.

- Creating a budget for your children’s futures

Your financial goals can also be a combination and should be to ensure you set yourself up for success in the future.

Determine if your goals are short vs long-term as this will massively influence how you approach achieving them. It’s also important to know how much risk you’re willing to take if your goals involve things like mortgages or investments. Remember to be realistic; if you have a big long-term dream, break it down into smaller, attainable goals to get there.

Review Your Current Financial Situation

Once you have identified your goals, it’s time to look at where you are currently to see how you can reach those goals.

Start by gathering all your financial documents and accounts:

- Bank accounts

- Pensions

- Investments

This is especially important if your goals relate to investing or retirement planning. Look at your current income and make a list of all potential income sources including side jobs or freelance work that consistently brings in money.

Create a budget

We would also recommend to all our clients to create a budget. Use all the information you’ve gathered to create a comprehensive plan of your spending. Budgets are great for determining where any bad spending habits might lie and identifying in which areas you can cut back. To get started in creating your budget, check out our free to use Budget Calculator on our website.

After you do this, you’re ready for the next (and most important) step.

Discuss Your Goals with a Financial Advisor

The importance of a financial advisor cannot be understated. Most people don’t go to financial advisors for help and instead seek out friends, family, or the internet. While these sources can be a great starting point, it’s important to remember that what worked for others might not work for you.

Working with a Financial Advisor

A financial advisor is a trained professional who will help create a comprehensive plan that best fits you as well as navigate complex financial products and provide insights on how to optimise investments.

Importantly, a financial advisor is also a neutral third party. They can offer advice that is unaffected by outside biases that may cloud the judgment of those closest to you. Financial Advisors help by checking in with you consistently and once you’ve built a partnership, check-in to make sure you’re staying on track.

Define Your Financial Plan

Your financial advisor can help you create a personalised financial plan. This plan will be based on the goals you set up in the beginning in combination with your current financial situation. It will focus on guiding you towards completing your goals in the most effective manner.

A financial plan is a great way to help:

- Pay off your debt

- Increase your savings

- Lower your spending

- Increase retirement savings

- Increase family savings

- Create a general budget to manage spending

Again, the plan depends on your financial needs, so you can tailor it to what you need. Your plan is the strategy for achieving the goals you originally set, so it is a roadmap to lead you to those achievements. It can also help you plan for unexpected events so you can continue in case of any setbacks.

Implement Your Plan

The hardest part of creating an effective financial plan is implementing it. Be sure to track your spending throughout the process to ensure that you’re staying on track with your financials.

We can help you set up and create a financial plan that is easy to track and manage but if you are looking to create your own budget plan, our budgeting tool is a great source to get started budgeting on your own.

Another way to implement your plan is to automate transfers each month to different accounts so that when you get paid, your money will go right into the different accounts it needs to. It can be difficult to stay disciplined, but focusing on your goals and reasons behind your new system will help.

Keep Track of Progress and Adjust (If Necessary)

It’s important to celebrate the small wins; even one or two months closer to your goal is better than before and it’s important to recognise that. On the other hand, don’t get discouraged if you go over budget or any emergency expense means you can’t save as much as you wanted.

Life happens, and you must react accordingly. If the plan isn’t working for you, don’t be afraid to speak to your financial advisor and make changes that will put you on a better path to fulfilling your goals.

Financial Advice from Alpha Wealth

Financial planning can be complex, but it doesn’t have to be overwhelming. Creating a plan is a crucial step in achieving financial security and stability.

Alpha Wealth is here to here to help you to take control over your financial future. Book an appointment today so that you can build a financial plan that will set you up for success.