Yes, I know your next question is, “but do pension make sense? ” Below I have listed a few reasons why you should consider contributing towards a pension.

At retirement could you survive on €238.30 per week?

This is the current personal state pension. Think of your bills, holiday, car, socializing and of course your day to day expenses. Starting is a pension is undoubtedly one of the smartest decisions you can make. It could help ensure a brighter, better future to look forward to. When you’re choosing a pension, having all the information you need is key. So we’re here to help you select one that’s right for you.

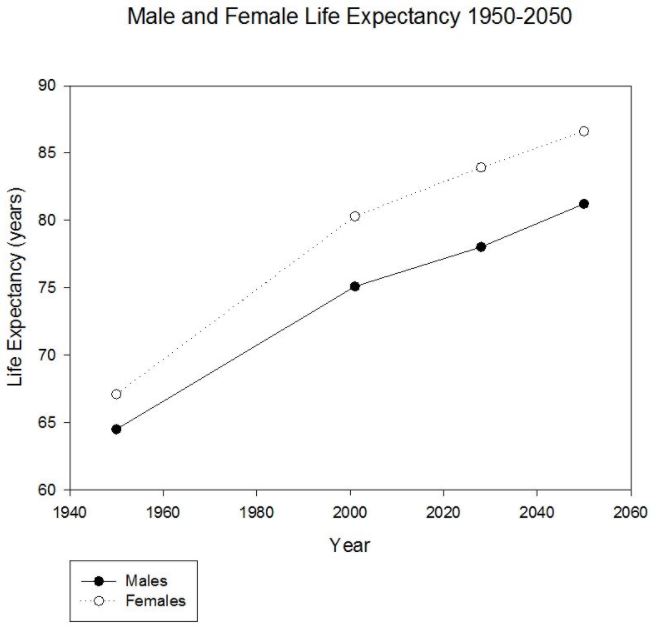

The state pension age is increasing to age 68 for those born in 1961 or younger. There is evidence to suggest that this will keep increasing with life expectancies increasing. At Alpha, we like to make things as simple for the client as possible in what is a jargon-heavy industry. Simply put, currently, in Ireland, there are 5.3 adults of working age for every pensioner, but this ratio is predicted to change to 2.1 to 1 by 2050. As Life expectancy for those born in Ireland is now is 78 years for males and 82 for females and is expected to increase year on year. The idea of retirement can take some getting used to. It is a time when all the major points in our life will change – our daily routine, our financial means, our role, status, and identity are all affected. Preparing yourself, understanding the time ahead and taking control are all key parts of the planning process.

Other pension benefits

- Tax relief of 40% or 20% available, as above …. €1,000 contribution = €400 tax reduction or rebate etc….

- Tax free growth on pension funds

- Tax freelumpsum of up to €200,000 on retirement

- Tax free death benefits

- Tax efficient income options at retirement

What are my options?

You will have a number of options at retirement and, within certain Revenue rules, you can combine options in whatever way suits you. The number of options available to you at retirement depends on the type of pension you have.

The four main options at retirement vary, but are broadly:

- Buy an annuity (i.e. an income in retirement).

- Invest in an Approved Retirement Fund and/or Approved Minimum Retirement Fund (these two we can talk about in another blog).

- Take a taxed cash lump sum

If you want to retire wealthy, then plan for it!

Visit Alpha Wealth’s website or give one of our advisors a call on 021 2061780