The Unlendables

One of our most frequently asked questions here at Alpha this summer has been about Mortgages. Homebuyers are desperate to get on the housing ladder are being refused mortgages because they do not fit the mould defined by lenders in Ireland.

These apparent “mortgage misfits” cannot get the loan they need to buy their dream home because banks believe that lending to them is too risky. However, the fact remains that many of those being rejected have strong earnings potential and may even be in permanent secure jobs.

We constantly encounter borrowers, such as self-employed workers or older people, who are frustrated at being denied a mortgage because of the strict lending criteria set out by banks. Nick Charalambous MD of Alpha Wealth said: “I take phone calls every week from dissatisfied self-employed people who feel they are being unfairly treated when it comes to applying for a mortgage. It is evident that they are at a huge disadvantage compared with PAYE workers.”

Here’s how to tell if you if you’re one of Ireland’s mortgage misfits:

You’re newly self- employed

Self-employed workers need to show several years’ earnings to get a mortgage, while PAYE workers need only to show their past six months’ wage slips.

The requirement to have at least two years of financial statements means that any people who have recently become self-employed, even if they are currently earning a good income, will not get a mortgage. Even newly self-employed workers able to show three years’ accounts can find themselves stymied in how much they can borrow, because banks base the mortgage on their average annual income, which may not reflect their current earnings. Nick Charalambous, MD of Alpha, said: “There are a lot of set-up costs with starting a business, which have an impact your ability to generate income in year one. I know from experience as we are only coming up to our 5th year anniversary as a new business”

You have bad credit

Banks use your credit rating as a tool when deciding to approve a mortgage, so you will struggle to get a mortgage if you have a poor credit history. It takes five years from the time a loan is repaid to clear off your credit record, and lenders will often refuse credit even if your debt problem was temporary.

If it was a minor blip and there was a good reason for it, you might be OK. But if you missed payments on a mortgage, have a revoked credit card or an unpaid student loan, then the mainstream lenders won’t consider you. We strongly recommend starting a savings account from as little as €100 per month which shows you’re an active saver and keeps that money aside for when you need it most. Online gambling and evidence on your credit card statements of paying Paddy Power and other internet bookies is a ‘red flag’ that may stop you getting a mortgage. And as well as backing slow horses, a hedonistic lifestyle with erratic spending habits and cash withdrawals on your credit card, even while on your sun holiday, can also stop you getting your foot on the property ladder. Even though it’s been a great year to date for Cork sport maybe you should just go and support them rather than putting your savings on Cork winning in September.

You’re over 40

The longer you leave it after turning 40, the harder you will find it to get a mortgage. In general, owner-occupier mortgages are available for a maximum term of 35 years, with banks insisting you have your loan paid off by between 65 and 70, depending on the lender. Bank of Ireland and Permanent TSB give borrowers up to the age of 70 to pay off the loan. KBC will give you until you are 68, while AIB requires that your mortgage is cleared before turning 66.Another problem I would like to highlight was that, even though the retirement age goes up to 68 in 2028, some lenders will lend only up to 66. Older borrowers are also curtailed in the size of their mortgage. For example, if you wait until you are 45, the maximum mortgage term is 20 years with some lenders, which pushes up your repayments and limits what you are able to borrow. Those in their late fifties or early sixties may not qualify at all.

You have young children

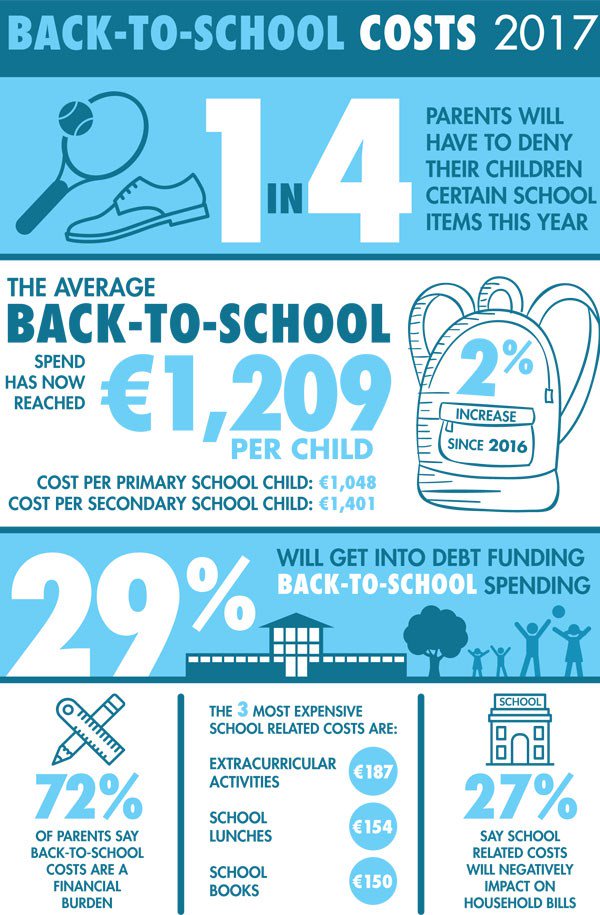

Having children can turn you into a mortgage misfit by curtailing how much you can borrow. Banks reduce your net disposable income by €250 a month per child when calculating what you can afford. If you’re also paying childcare costs, the amount you can borrow is hammered. Having two children reduces what you can borrow by anything from €20,000 to €30,000. A survey commissioned by the Irish League of Credit Unions claims average return-to-school spend continues to increase and has now reached €1,209 per child. This is the costs over the course of the school year. The survey found 72% of parents feel the back-to-school spend is a financial burden, with more than a quarter saying the costs will impact negatively on household bills. Banks recognise this and will have to account for all these costs when giving you mortgage approval.

Financial Advice

If you are having money worries, look for help as soon as possible. If you are having problems making repayments on a loan or credit card, contact your provider to explain your situation. Whatever you do, don’t ignore the problem. Missed repayments could affect your credit history and could mean difficulty getting loans in the future. Finally, don’t forget, for great advice on money management and how to plan for your financial future, you can avail of our complimentary expert advice today! With our help we will make sure you’re not one of the Unlendables. Click here to make an appointment https://alphawealth.ie/contact/ or call us on (021) 2061783