“Education is the most powerful weapon which you can use to change the world” – Nelson Mandela. This investment in knowledge pays the best interest, however, are our pockets being stretched too far? Have you felt the financial pinch of back to school costs? We’ve some tips to help you find it easier financially next year whether you’re the parent of a primary school pupil, secondary school student or have a child going to third level next year. As the school term starts back, parents across Ireland will be busy preparing packed lunches, laying out uniforms and helping primary school children pack their schoolbags and saying their last goodbyes to their babies who are leaving the nest for Uni. And guess what, chances are you are underestimating the cost of sending them to school and college.

True cost of back to school

The truth is that many parents still dread back to school due to the costs. The Irish League of Credit Unions took a look at just what the costs for both primary and secondary school children are. It found that back to school costs negatively impact 29% of household bill payments, with 16% of parents saying they will have to sacrifice spending on food to cover these costs.

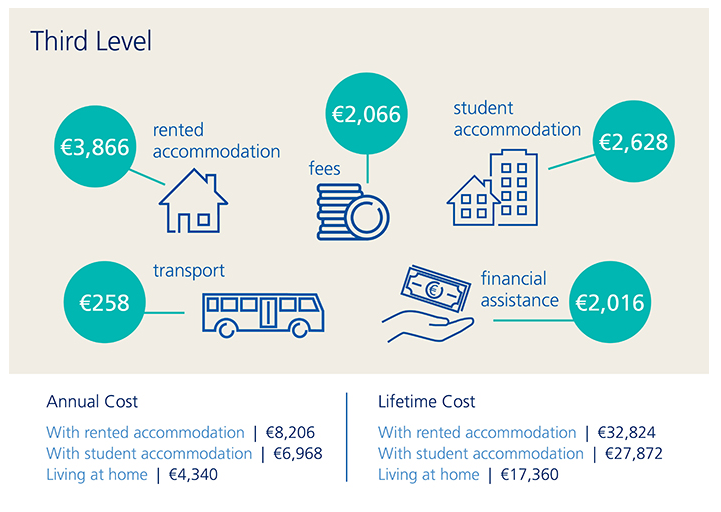

College doesn’t come cheap and by the time a teenager reaches third level, parents are really feeling the cost of putting their children through university or college. A 2017 Personal Finance Education survey reveals the true cost of third level education in Ireland, and it’s not surprising to learn that accommodation and college fees are the highest spend items during the college year. The cost of accommodation for the college year ranges from €2,628 to €3,866 and college fees start at €2,066. Given the high cost of accommodation for students either living in student or rented accommodation, it’s unsurprising that 60% of students who are currently in third level live at home.

A great education is the best possible start in life and for most parents ensuring they can provide for their children’s education, from primary school right through to third level, is crucially important. Two thirds of parents who were surveyed for the Cost of Education report said they want to open a savings account as early as possible in their children’s life. With the Aviva Regular saver you can gradually build up the funds necessary to support your children’s education and future.

Is it time to switch your Mortgage Protection?

When it came to deciding which school to send your children to you likely weighed up a range of factors such as the location of the school, what you had heard from friends and family, and even your own experiences if you still live near where you went to school. However, when you purchased your home it’s unlikely that you put a similar level of research into where to purchase your mortgage protection and because of this you could be paying far more than you need to. Most first time buyers opt take mortgage protection from their bank in the hopes of avoiding additional paperwork and what is a hugely chaotic time. However, if this is what you did you could be paying over €200 more than you need for mortgage protection. No matter how long is left on your mortgage, getting a quote from other mortgage protection providers could help you make a significant saving per year. And guess what, we can give you free quote in a few simple steps.

As your children start a new routine, should you kick an old one?

With the end of the summer holidays your children’s’ routine of summer relaxation is going to change pretty drastically in the approaching weeks. As your children begin a new routine and new habits, it may be time for you to kick an old habit if you’re a smoker. On average smokers pay 90-100% more got life insurance than non-smokers but the good news is that if you give up or are an ex-smoker you’re not doomed to a lifetime of higher premiums. Once you’ve maintained a tobacco-free lifestyle for a period of 12 months or more, most life insurance providers will class you as a non-smoker helping to significantly reduce the cost of cover.

While the cost of sending a child to school is an unwelcome surprise for most families at the end of every summer, taking the time to re-assess your current insurance policies to see where you can make savings could help reduce the financial burden while also ensuring you and your children’s long-term future are fully protected at the best price.

For more details please feel free to email epollard@alphawealth.ie or call 021 2061783 or visit our website www.alphawealth.ie

Sources: Irish League of Credit Unions Survey 2017

Zurich Education Survey 2017