29% of smokers in Ireland currently use e-cigarettes as an aid to quitting smoking. If you’ve been a vaper for over 12 months then you’re classed as a non-smoker according to certain life insurance companies. This means you will pay the same price as a non-smoker.

However, applying to the wrong insurer will leave your pockets emptier. This brings about the argument around Smoking Vs Vaping:

You see some insurers aren’t as understanding when deciding how vaping affects life insurance. As soon as they hear you use e- cigarettes alarm bells will start ringing and they’ll class you as a smoker making you pay smoker rates. Is this fair what the insurers are doing? Well, smokers pay around twice as much as non-smokers because around 1 in 2 smokers will die of a smoking related disease. So, if I quit smoking using e-cigarettes, my chances of dying from a smoking related disease lessen and therefore I should get non-smoker rate?

You see some insurers aren’t as understanding when deciding how vaping affects life insurance. As soon as they hear you use e- cigarettes alarm bells will start ringing and they’ll class you as a smoker making you pay smoker rates. Is this fair what the insurers are doing? Well, smokers pay around twice as much as non-smokers because around 1 in 2 smokers will die of a smoking related disease. So, if I quit smoking using e-cigarettes, my chances of dying from a smoking related disease lessen and therefore I should get non-smoker rate?

The following conditions apply to the 6 main Life Insurers in Ireland:

- Aviva Life & Pensions and New Ireland Assurance classify users as non-smokers, provided they have not smoked any other form of tobacco in the previous 12 months.

- Friends First, Irish Life and Royal London classifies users as smokers.

- Zurich Life applies a 50% loading to users who do not smoke any other form of tobacco and have not done so in the previous 12 months.

Is there really any difference in the price?

You better believe it, the difference in premium between a smoker and non-smoker when applying for life insurance is massive. To find out some exact figures I received a quote using this calculator which compares multiple insurance companies and distinguishes between smokers and non-smokers.

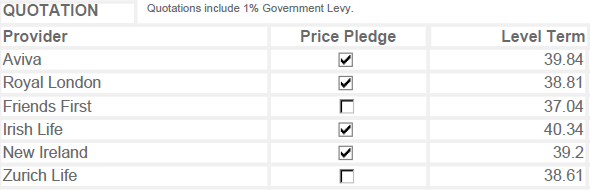

Name: Mark

Applicant: Smoker

Date of birth: 1/1/1990

Life Insurance: Cover of €500,000, over 20 years, paying yearly (price show below per month)

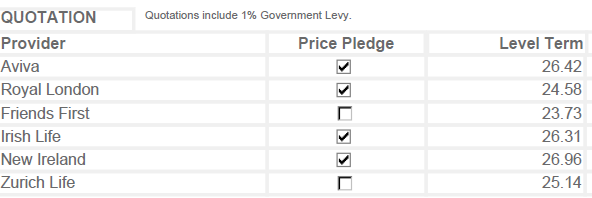

Name: Joe

Applicant: Non smoker

Date of birth: 1/1/1990

Life Insurance: Cover of €500,000, over 20 years, paying yearly (price show below per month)

These quotes show that a smoker will pay up to 92% more than a non-smoker.

To be classified as a non-smoker you will have to be off tobacco products for a minimum of 12 months. I’d try vaping now if I was you!

A heavier wallet

I speak about it time and time again in our blogs about making decisions that will lead to a more sustainable financial future. And guess what… vaping can save the average smoker €3,200 a year. That was only the cost of purchasing the materials. By taking into account your insurance premium you are looking at a saving around €3,400 a year on average.

If you weren’t convinced of the financial benefit of vaping, you should be now. If you have a Mortgage and given up smoking in the last 12+ months (even to go onto vaping) you will qualify for at least a 20% saving on your existing Mortgage Protection Plan through arranging a free consultation with us via phone email or face to face.

So the balls in your court…

Have you been vaping for the last 12 months and want non-smoker rates? Contact us today!

Reducing the cost is very easy.