Without wanting to appear to sound like the grinch, Christmas is a really bad time for a lot of us as our best laid plans go pear-shaped this time of year. Even if you are normally sensible about money, this is a time of year when everything pushes you to splash out.

Children’s ever increasing growing list to Santa (that mimicks the Smyths catalogue) as well as social media ads and bloggers showing all the new devices, gadgets and increasingly expensive “must have’s” are a tsunami against staying in the black. Christmas seems to have started earlier this year than I can ever remember with ads and displays like the one in Brown Thomas appearing before Halloween ! If you add this to the fact that “Black Friday” which has already started but is officially at the end of the month and “Cyber Monday” at the start of December, are a week closer to Christmas than last year, it is a long period of spend, spend, spend. Also the way we shop is also changing.

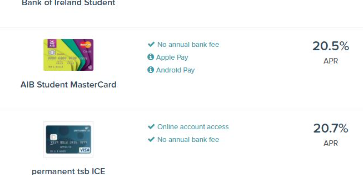

Last year over half of us bought something online either daily or weekly and one in five of us are shopping via our mobile phones. There are three pieces of advice I can give you. One is to avoid the unnecessary extras such as festive liqueurs or fancy crackers. Do they really add to the experience ? The second is to do a kris kindle for the kids. Children are the most expensive part of christmas and when you have a load of nieces and nephews on top of the possibility of buying for your your own kids, the cost gets totally out of control. The third and the most important one is to decide on your spending limit. The key is to not fall into the trap of spending more than you have with a plan to pay it off later. Paying for holiday gifts on a credit card is never a good idea. One in four of us put at least some of their festive spending on plastic, and one in 14 dip into an expensive overdraft.

The best way to not overspend is to make a shopping list. This way you can use “Black Friday” and “Cyber Monday” to your advantage with getting items for less than you budgeted for. Once you begin the holiday season, keep track of all your purchases. It takes discipline but by bringing your gift list, along with your budget sheet, with you on every shopping trip really does help. Additionally, be sure to keep track of the cost of your holiday-related outings and other spends so you will be able to more accurately budget next year. The average Irish Christmas budget is €578 while over 13% of us have budgeted over €1000 or more. As you begin to purchase gifts and spend money, be sure to subtract the amount from your running Christmas budget total. This will let you know how well you are sticking to your budget and will make it easier to make adjustments between categories if needed.

Tracking your spending is the biggest key to sticking to your budget. When holiday shopping, stick to a cash-only system. Putting the gifts on a credit card makes it easier to overspend. Shopping online can save you money and time as you comparison shop. I recently learnt that of a website CamelCamelCamel.com which tracks the prices of Amazon items and will show toy whether you are getting a good deal.

Don’t forget to look for free shipping codes and allow plenty of time for your gifts to arrive. Many online stores offer extra savings and free shipping over the Black Friday weekend. Be sure to check out the Cyber Monday sales, as well. However be mindful that clicking offers on social media of fake websites. Also check the company’s website independently to see if the deal is being offered by them. Rogue ads can take you to a fake website, harvest your bank details and charge your account. Finally if all else fails, agree to see groups of people in the New Year. Then you can buy their presents in the January sales or consider a cheeky re-gift or two.

Nick Charalambous is a qualified financial advisor with Alpha Wealth, with Offices in Cork and Dublin.