It appears that people are envisioning a Brexit scenario to be much like the post-apocalyptic future of the Terminator movies after judgement day.

In three days time we could wake up to a radically changed world, a different Europe, a different Britain and Ireland caught in between both. One thing we’re all wondering is if in the event that Britain does choose to leave, will it be as apocalyptic as the remain side make it out to be?

In recent weeks the Brexit debate has cranked up and much can be said about Ireland’s significant relationship with Britain. Our economies, history and commerce are closely intertwined. Fears over the ramifications of Britain leaving the EU are causing market turmoil, but what does Brexit mean for you?

However, the main question is not how to deal with it in the next few days, but how to deal with a profoundly different investment and business environment in the wake of a redefined Europe.

UK/EU relations

Free trade between Ireland and Britain has always been important to the Irish economy. In 1928, the interdependence of the two economies was acknowledged by the creation of a new currency, the Irish Pound. Its exchange rate with sterling was fixed at parity. The significance of the economic relationship was one of the reasons that Ireland and the UK joined the European Economic Community (‘EEC’).

Ireland was always a more enthusiastic member of the European Union. The relationship between the UK and its European partners has always been more strained.

There has never been any real enthusiasm in the UK for membership of the single currency with one of Cameron’s key demands of remaining in the EU being an “explicit statement” that the euro is not the official currency of the EU, making clear that Europe is a “multi-currency” union. Many individuals want this declaration in order to protect the status of the sterling as a legitimate currency which will always exist.

Most UK political parties oppose any further transfer of sovereignty to Europe. The lack of vivacity towards Europe has been best displayed by the substantial increase in support for the UK Independence Party (‘UKIP’), which wants Britain to leave the EU.

How likely is a British exit, or a ‘Brexit’?

Unless the result is very close, we should have a clear idea of whether the UK has voted to leave the EU before the official announcement is made. This is because individual local authorities will be declaring their results as and when the votes are counted, so we’ll have a good idea of what’s happening around the country before an official declaration.

Most financial markets still believe Britain will vote to remain (despite recent polls). This alone means that the impact of a Brexit vote is likely to be considerable. That being said; Paddy Power are convinced that Britain will vote to remain, which is good enough odds for most of us.

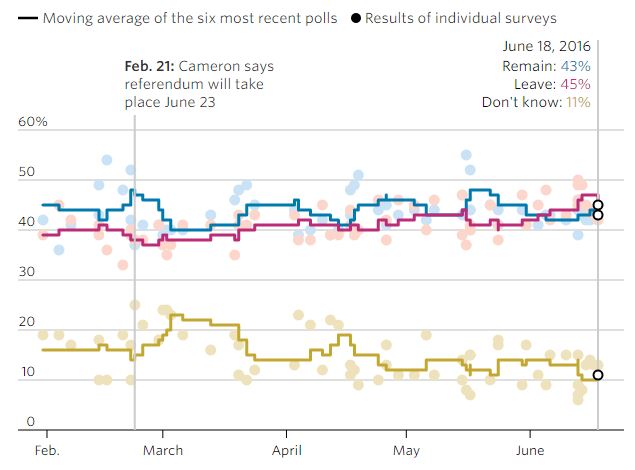

Source: WSJ analysis of WhatUKthinks.org data from polling companies ComRes, ICM, YouGov, Ipsos Mori and Survation.

What would the impact of a Brexit be?

Although the probability of a British exit from the EU mixed, it is worth exploring what the consequences would be if it were to happen. They will greatly depend on the new relationship between the UK and the EU after the exit.

Britain would probably form a relationship with the EU similar to the relationship already in place between other countries outside the EU, including Switzerland, Norway, Iceland and Liechtenstein. They have formed a European Free Trade Association (‘EFTA’) for the promotion of free trade and economic integration. Norway, Iceland and Liechtenstein have a joint European Economic Area (‘EEA’) Agreement with the EU while Switzerland has signed a set of bilateral agreements with the EU.

If the UK set up a similar arrangement the implications for the Irish economy would be small. As the UK is not a member of the Eurozone, the currency situation would remain unchanged and there would still be free movements of goods and services. Renewed border controls between the Republic and Northern Ireland seem a very unlikely prospect.

Links between the two economies are still very strong

However, if the new relationship between the UK and the EU degenerated and trade barriers and tariffs were erected, then the consequences for the Irish economy could be drastic. The dependence of the Irish economy on Britain has fallen in recent decades, but it remains a significant trading partner.

When Ireland and the UK joined the European Economic Community in 1973, over 50% of Irish exports went to the UK. That figure has dropped to just over 16% today. Although over 40% of Irish exports go to the remainder of the EU, the UK remains our single most important export market in Europe.

The real importance of the UK as a trading partner is perhaps a little understated by these figures in the event of Brexit. In contrast to exports to the US, a much higher proportion of exports to the UK are from indigenous Irish industries where the real economic value added is considerably higher. Perhaps a better indicator of the economic relationship between the two economies is the fact that more than one-third of Irish imports come from the UK.

Border argument

While the European Commission is not commenting as it does not want to appear to be biased towards either side, the Revenue in Ireland is investigating the implications, such as the costs of border checks.

Leave campaigners say the focus on the border is disingenuous and point out that the EU has a border with a non-EU country that is unpoliced between Sweden and Norway.

Whilst these countries may be in the Schengen Area, one has to remember that Ireland and Britain had a common travel area before either were in the EU and that arrangement has prevailed over the years.

Personally, I believe that any fears regarding the North-South relationship will be addressed quickly.

Article 50 of the Lisbon Treaty provides for member states to leave the EU in accordance with their own constitution. However, it does not say how this would be handled.

The most interesting concept is whether the EU would push the Irish government to enforce a border crossing with the north or whether Ireland’s government would resist such a plan.

The Unique Position of Irish Investors

A lot of Irish investors are invested both directly and indirectly in UK assets. So, much of the exposure will come from cross-border trade and vulnerability to the Sterling. In the event of a Brexit, the currency risk is a major worry. It can be difficult for investors to quantify their exact exposure to sterling. For example, in an Irish-listed, Irish-owned company that does a lot of business in Britain would have a currency risk.

Internationally Brexit will not affect how investors operate forever, but due to our unique connection with Britain, it will be the biggest local market event since Ireland joined the European Union.

Our advice would be to make plans and stick by them, but by all means, be flexible and adjust your plans in the event of a drastic change in circumstances.

The reality is that nobody knows whether Brexit will be a bump in the road or a climatic catastrophe. This combined with Trump in the US, China is slowing down and low bond yields have certainly created undesirable market conditions for almost everyone.

The Future

It appears that people are envisioning a Brexit scenario to be much like the post-apocalyptic future of the Terminator movies after judgement day.

Luckily, if it does happen there should be no immediate impact upon your job or your income. This does depend on your exposure to the UK market, especially if you are a business owner.

The most compelling concern is whether Britain’s former EU partners will be hostile or benign when it comes to negotiating Brexit. In the event that it happens, it will be the defining factor in how the Irish economy will behave.

The priority for EU negotiators will be to ensure that Britain does not secure a competitive advantage by virtue of its decision to leave.

The financial services industry could receive a real boost in Ireland post-Brexit. It could become increasingly difficult to obtain licenses to provide services on the European mainland. The Irish economy will benefit from the significant international investment due to its strategic location in the EU, its English-speaking population and knowledge economy.

The glaring exceptions to this success will be to those farmers and SME exporters who had been heavily reliant to on the British market.