Shares in the third-largest European bank IPO since the financial crisis were over four times oversubscribed when they were sold last week. AIB’s listing on the main securities market has provided the Irish Stock Exchange (ISE) with the largest IPO in Europe in 2017.

Fact-find

AIB’s admission to a primary listing on the main securities market follows the sale of a 25pc stake in the group by the Minister for Finance, raising approximately €3bn for the State from Irish and international investors.

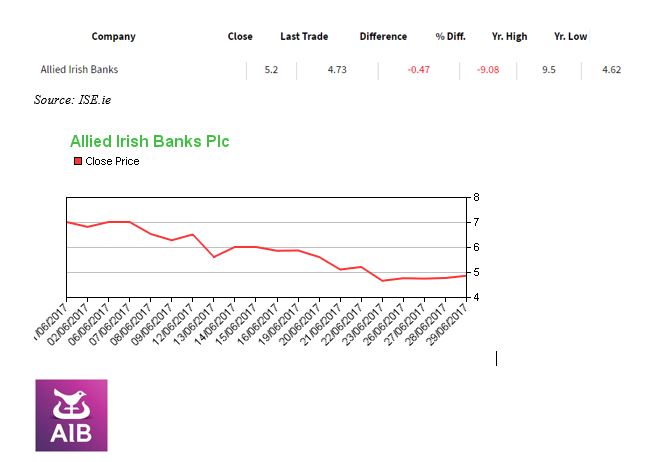

The consensus seems to be that it is a huge gamble and the brokers that purchase the shares and have made a profit should take it and run. AIB’s share price has been a rollercoaster for the last couple of months, going up by over 80pc to €9.50 in May and back down to €4.76 by June 26. The bank’s shares are trading over 7% above the initial public offering (IPO) price of €4.40. (June 27 2017) The size of the IPO will rise to 28.75% if demand proves strong following the debut, after the Government included an over-allotment, option. The increase would add another €400m to state coffers.

What is your attitude towards investment risk?

A lot of people in the 2000s held bank shares as they were seen as a low-risk investment that paid a good dividend. Equities are a high-risk asset class it doesn’t matter how strong their balance sheet may look or how good their income projections are, there can be extreme volatility in the short term.

If you are a low-risk investor that is going to lose sleep if your investment drops 10% then buying shares probably isn’t something you should be doing…..

If you do believe that financial stocks are where your money should go then would you choose AIB over all the other global banks that you could invest in such as Santander, JP Morgan, Lloyds etc., most of which will pay you a decent dividend? The company has changed since it was bailed out by the Irish Government. The new AIB that is being offered to the public is a very different company which has had some of its prized assets sold which include global bank shares in the U.S., Singapore and Poland.

Risk factors of purchasing the shares

- AIBs businesses may be affected if there is any slowdown in the economic conditions of Ireland, the UK and globally.

- Disruption of markets due to recent EU and US politics like the French elections and of course

- The shift in ownership does not change AIB’s credit fundamentals or ratings, but the Government’s decision to start the sale process was due to the bank’s improving financial profile, which this year enabled it to pay its first dividend since 2008.

- AIB still has a high proportion of non-performing loans, low-yielding loans – including tracker mortgages – and defaulted but not impaired loans

Proceed with caution and don’t get caught up in all the hype…( see below).

Ireland’s finance minister said following the “sale that he could review a pledge to sell a maximum of 25 per cent in any of its bank shareholdings by the end of 2018 after AIB hit that limit.” On June 28 2017, as we expected at Alpha Wealth the AIB IPO proved investors are perfectly happy counting loan write-backs as an integral/sustainable component of earnings. At this point I wouldn’t necessarily disagree… there’s likely a multiyear tailwind of loan writebacks still to come from AIB. I believe that AIB has played it fast and loose and this will be their 4th year of write-backs already. But what’s interesting is the potential implications for the Bank of Ireland, which hasn’t yet recorded any (net) loan writebacks. Judging by AIB, arguably Bank of Ireland could actually record a €650 million swing in its loan provision line… in a single given year. This €650 million swing in provisions would imply a potential 60-70% bump in Bank of Ireland earnings!

Opinions voiced by Eoin Pollard- please address any questions or queries to epollard@alphawealth.ie. We would love to hear what you have got say – please let us know if there is anything you are unsure of or would like us to expand upon.