Be different

As financial advisors we are often asked whether it is worth the cost to hire a financial advisor. I know, very ironic. After all, there is a cost to make you money. People say they can listen to the news to find out where and how to invest, so, “Wouldn’t I be better off just keeping that fee for myself?” That is an excellent question with an answer that depends on many factors. First and foremost is that Alpha Wealth is unique in its practices to a huge proportion of brokers across Ireland. We look at all aspects of financial management and we offer free financial reviews. Yes, you did hear that right. Exiting, right?

What direction should I go in?

Good financial planning decisions extend well beyond where and how you invest. Financial advisors have a range of tasks they manage for clients. How well they do it can add to the bottom line of your portfolio. Our financial advisors show that good decision making can enhance sustainable lifetime income on a risk-adjusted basis.

The ability to spend more than you could have otherwise can be interpreted as meaning that the assets earned a higher return net of taxes and fees to make that spending possible. While there are many different aspects of the financial planning process, we have found that we add value in three core areas.

Portfolio Construction

Constructing a well-diversified portfolio that is both tax and cost efficient is one of the ways Alpha Wealth can help you increase your investment returns. We also want to make sure you stay diversified, and don’t fall victim to the temptation to put all your eggs in one basket. From experience in industry we have found that many do it yourself investors find themselves chasing the latest ‘hot stock’, usually at the tail end of a long run. Investors without a plan will ultimately buy high, sell low when they run out of patience, and repeat the process into oblivion. Therefore we really recommend that you don’t make the same investments like stockbroker Jordan Belfort did in Wall Street.

Behavioral Coaching

We as advisors have the ability and the time to evaluate your portfolio investments, meet with you to discuss your objectives, and help get you through tough markets even when your emotions try to get in the way. All of these factored together potentially add value to your net returns over time. The single greatest cause of failure in the investment markets can be attributed to emotional decision making. It is no secret that people are emotionally connected with their money. We work so hard for it who can blame us. However, allowing your emotions to cloud your judgement and decision making is sure to drag down your portfolio. By working with us we will keep you calm, cool and collected even when the chips are down.

Wealth Management

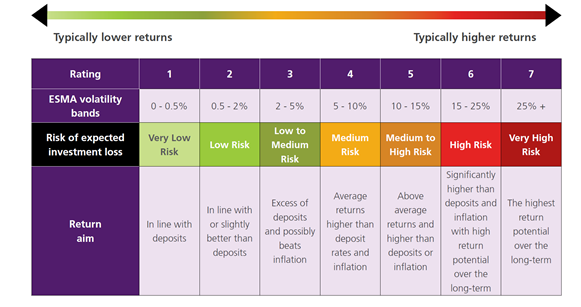

This part of the job entails making regular changes to your portfolio to help reduce risk. It also involves helping clients financial and investment advice, tax services, retirement planning and savings. Our strategy is will develop a plan that will maintain and increase our clients wealth based on the individuals financial situation, goals and comfort level with risk. After the original plan is developed, the manager meets regularly with clients to update goals, review and rebalance the financial portfolio, and investigate whether additional services are needed and with the goal of remaining in our clients service throughout his/her lifetime.

Don’t just take my word for it, check out what our clients are saying about us https://alphawealth.ie/testimonial/

Do you need a Financial Advisor

If at this point your still asking yourself this question, let us answer it for you. The simple answer is yes. Everyone should seek the advice of a professional Financial Advisor.

If you live in the Cork area why not give us a ring and talk to us today and we will show you how we can help.