So the known unknown has actually happened. Britain, Ireland and the European Union now face a series of consequences and difficult choices in the short, medium and long-term. In a few hours everything has changed.

We noted in our last blog that people are envisioning a Brexit scenario to be much like the post-apocalyptic future of the Terminator movies after judgement day. Well.. it has happened, but it’s not all horror and despair. The crucial steps are the next 2 years. Let’s take a look at how Ireland might fair.

Noting we are in uncharted territory it is hard to estimate the effect of the vote on Ireland and Europe just yet. It is clear that Britain and Europe both face an area of economic and political turmoil, and that Ireland will be especially affected by this. It may be quite difficult to see how the effects will be anything other than overwhelmingly negative.

For the current Irish administration, the rest of its term of office will be dominated by the fallout from Brexit. The long period of Government formation now appears to be a walk in the park compared to what lies ahead.

We are now faced with a scenario where we don’t know how the EU and the UK will react to this decision. It certainly will be played out over the next year, but the uncertainly is what will affect the strength of the Sterling and the markets.

David Cameron gave an emotional speech this morning.

The UK needs to plan and execute a managed exit over the next 2 years to minimise disruption. They may have more flexibility with their tax rates to continue to attract FDI and may indeed review the penal stamp duty tax rates effecting London. There is a slight possibility of a 2nd referendum/re-negotiation on Brexit with the EU and possibly another general election in the UK.

The European Union now faces a crisis of its legitimacy, and its member states a crisis of their democracies. This will mean greater debate on whether the EU will hold up as a union against this storm.

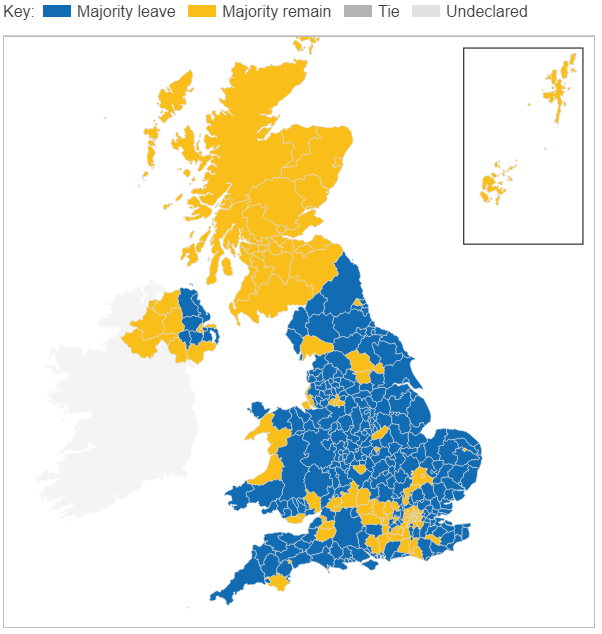

The breakup of the UK now seems closer than ever before, perhaps inevitable whenever the formal break with the EU comes. It certainly throw into doubt the future positions of the North of Ireland and Scotland (the last referendum being very close).

A lot of Irish investors are invested both directly and indirectly in UK assets. So, much of the exposure will come from cross-border trade and vulnerability to the Sterling. The currency risk is a major worry. Our advice is to mitigate this risk as much as you can.

Ireland must take advantage of this event. The financial services industry could receive a real boost in Ireland post-Brexit. It may become increasingly difficult to obtain licenses to provide services on the European mainland.

The Irish economy could benefit from the significant international investment due to its strategic location in the EU and its English-speaking population. We have strong links to the USA, a strong legal system for commerce and a business-friendly (tax-friendly) Government.

As for the border between North and South, it is in the best interests for both parties not to have a border reinstated for various reasons, not only economic. Perhaps it will be the case of instating non fixed border posts, but a less disruptive mixture of electronic filing and random physical checks. Many questions now need to be answered about the Common Travel Area which covers the movement of people.

Britain will hopefully form a relationship with the EU quite like the relationship already in place between other countries outside the union, including Switzerland, Norway, Iceland and Liechtenstein. They have formed a European Free Trade Association (‘EFTA’) for the promotion of free trade and economic integration. Norway, Iceland and Liechtenstein also have a joint European Economic Area (‘EEA’) Agreement with the EU.

There are unknown unknowns ahead, but we have to hope in the long run that things will smooth out.

Daniel Varian, is marketing manager of Alpha Wealth Limited and based in Little Island, Co Cork. Tel +353 (0)21 206 1780, email dvarian@alphawealth.ie or web here.

Follow Alpha Wealth on Twitter (@Alphawealthcork), Instagram, Google+, Linkedin & Facebook