In this blog post, we will be looking at what we think is the best child savings account in Ireland and why we recommend that our clients use this account rather than the ones mentioned below. We will discuss the interest and saving rates for child savings accounts and how a child savings plan can give you peace of mind to take control over your child’s financial future needs.

Interest Rates For Child Savings Accounts In Ireland

Below we have broken down the different child savings accounts in Ireland, only showing the important information you need to choose your ideal provider.

- EBS – Pay 1% with a maximum balance of €5000. Age 0 to 11. They also have a teens account for ages 12 to 17 with the same interest rate and maximum balance rules.

- Allied Irish Bank (AIB) has a ‘junior saver’ account which allows a parent to open an account on behalf of their child. They get an interest rate of 1% on the first €1000 – then just 0.01% on anything over that. Ages 7 to 11 only.

- An Post (State Savings) Childcare Plus account pays 0.63% – DIRT free (Deposit Interest Retention Tax).

This is equivalent to 0.94% before tax. You have to pay a monthly amount for 6 years to get this rate. The minimum monthly payment is €25 and the maximum is €1000. The maximum balance for this account is €120,000.

- Bank of Ireland has Regular savings account for young savers aged up to 12 years of age. The account has an interest rate of 0.25%. The maximum balance is €5000 – but there is no minimum or maximum monthly deposit – so you could put €5000 in one go if you had it.

Source: Money Guide Ireland

Other savings rates in the Irish market (Not Children’s Savings Accounts)

Best Child’s Savings Plan

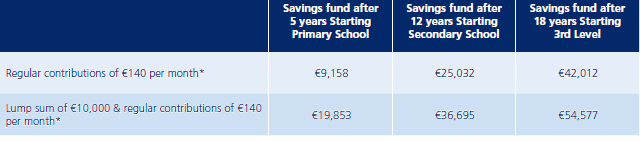

With regards to child savings here is some information on the best plan offering much better returns than the An Post, Credit Union or Irish banking options.

Why Save For Your Child’s Future?

As a parent, you want to give your child the best start to adult life. The Child’s Savings Plus plan is an innovative option from Zurich. It helps you to give a child a head start when it comes to financial matters. The Child’s Savings Plus plan also allows you to maximise the Gift Tax saving for the child by enabling you to legally assign the plan to the child, thus making full use of the annual Gift Tax exemption limit of €3,000 from any individual (€6,000 from a married couple). Our child savings plan is specially designed to allow you to start shaping a future for your kids.

What is a Child’s Savings Plan?

Child’s Savings Plus is a regular premium, unit-linked savings plan. It allows you to invest in a range of investment funds at the start of the policy, and once you make your choice of funds. The fund choice applies for the life of the plan.

Who’s Child Savings Plus for?

- Parents who wish to save for their children’s future.

- Relatives or god-parents who would like to put aside money for a child’s future.

- Those happy to save for a period of 5 years or more.

What are the main features of the Child’s Savings Plus plan?

- Peace of mind – by opening a Child’s Savings plan your kid will have a head start with college. Buying their first home, buying their first car or helping them set up their own business.

- Smart savings – this plan makes full use of annual gift tax exemption limits.

- Flexibility – you can vary your payments whenever you like.

How does our Child’s Savings plan work?

Opening a Child’s Savings plan is very simple.

- You can choose which Zurich Life Funds to invest in at the outset. We can help with that.

- You’ll need to decide how much you wish to put aside each month – it can be as little as €100. We can help you figure out how much you might need to save, depending on how long you plan to save.

- Then you can assign the policy to your child to maximise gift tax savings.

- Contact us if you would like to start today

Features of the account

In our financial advisor’s opinion, it is the Best of its type in that it offers the ability to pay in a minimum of €100 p.m. upwards and you can change or stop payment at any time and you can pay in lump sums also if you wish. On top of that are the additional benefits seen below.

- There are no exit penalties and is flexible in that you can encash at any time

- Low Fees – We would reduce the fees to ensure allocation 100% of your monies are put into the plan

- Tax is deferred until you take the money out so potentially interest rolls up tax-free each year left in.

If you would like to set up a child’s savings account to plan for your children’s future or a regular savings account for yourself, please do not hesitate to contact us.