Why do we recommend Zurich?

Have you considered starting a Zurich Savings Plan? Did you know the Banks, Credit Union, and post office offer 0% interest on your savings. We only recommend keeping your money in the Bank or Credit Union for your short term saving goals. Starting a savings plan with Zurich is a fantastic option because it gives you the opportunity to earn interest on your savings. This interest then compounds and once left alone for 3-5 years or more, you will see significant growth in your savings.

1. Consistency

Zurich have a great track record and have consistently performing funds. Zurich manage the funds and have our complete trust.

2. Ease of Access

With Zurich you have access to all your funds all the time and can withdraw them without facing an exit penalty which makes a Zurich Savings Plan extremely attractive in comparison to other savings plan which incur penalties when withdrawing funds.

3. Diversification

Zurich will invest in a diversified range of funds to minimize risk. It is an actively managed multi-asset fund with investments in equities, bonds, property and commodities.

The Alpha Savings & Investment Club

We highly recommend that you consider joining our savings & investment club. Our main objective is to make your money work harder for you. Whether it’s for saving monthly for a property, your kids, or your retirement. We can help take a step closer to financial freedom.

Why Join?

- Free savings & investment consultation on joining

- Can be started for as little as €100 per month

- Access to members only content & on-going advice and updates from advisors

- Join over 1,000 happy clients who are growing their savings in the Alpha Savings & Investment Club

- Access to well diversified funds with consistent long term track records.

Zurich Funds We Recommend

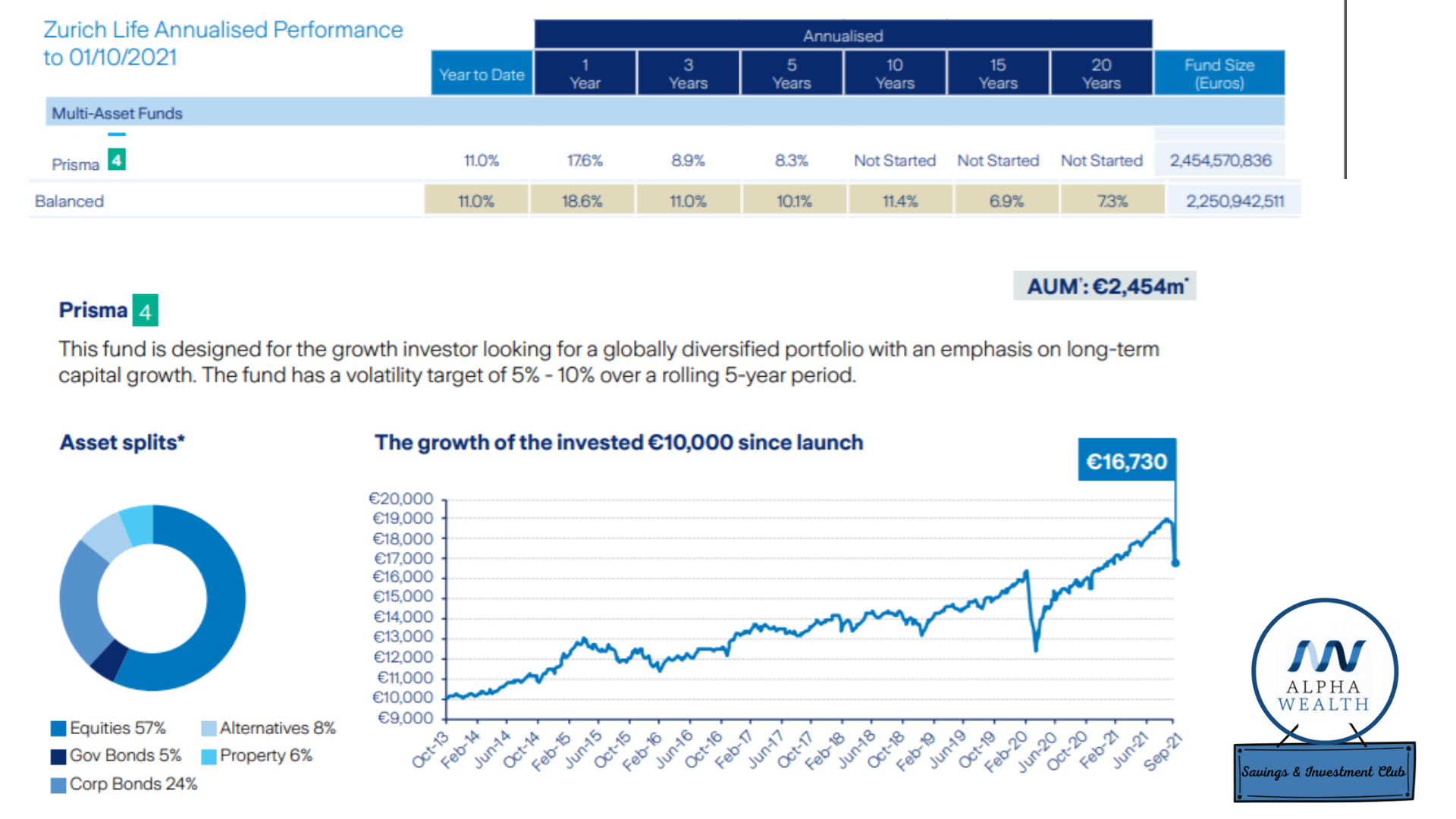

Prisma 4 Fund & Zurich Balanced Fund

We recommend two funds as part of our Savings & Investment Club. Both of these funds have performed exceptionally well over the last few years. The Zurich Prisma 4 Fund and the Balanced Fund are currently up 11% YTD.

Zurich Fund Performance