After a year of limited spending opportunities many of us have spare cash in the bank — and you can make it grow at any age or over any timeframe through investment.

According to the Central Bank of Ireland’s quarterly bulletin, released last month, Irish household deposits have “soared” during the pandemic. This is due to a combination of higher precautionary saving and reduced spending opportunities.

There have been better times to have extra cash: right now there is little opportunity to spend and little thanks for saving, with low interest rates and banks considering charging for the privilege of holding your money. So is this the perfect opportunity to invest?

Nick Charalambous, managing director at financial adviser Alpha Wealth, suggests a life company investment bond such as Zurich’s Easy Access as a good option for couples or single people with a longer investment timeframe. “This allows access to the funds without any early exit penalty, and you choose a risk level that suits you.”

Charalambous says the medium-risk Prisma 4 fund would be most appropriate: look for a 101 per cent allocation rate and a 1 per cent to 1.5 per cent per annum management charge to help offset fees. You will pay exit tax of 41 per cent on gains, as opposed to the 33 per cent capital gains tax you will pay on equities.

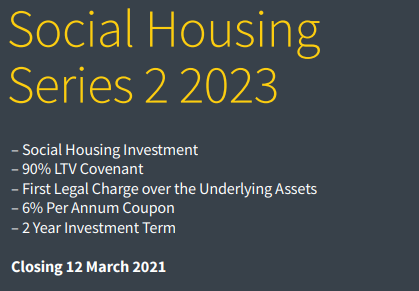

Another option worth considering, he says, is social housing investment via the likes of BlackBee. This offers 6 per cent per annum over two years, secured against social housing sites around Ireland. “One of the advantages is that the tax treatment is capital gains tax, which is more favourable than exit tax,” he says.

Fore more information please do not hesitate to contact us

Zurich Easy Access Savings Calculator:

The Blackbee Social Housing Bond Series II

It is a 2 year investment providing 12% return (secured against a diversified portfolio of Social Housing Units with the Government as a tenant). This type of Investment has proven it is the most resilient throughout recent restrictions and has been an area of much focus from the Government in the Budget last year to resolve the record levels of housing waiting lists.

Like tranche I, there is significant demand for this type of investment due to such attractive characteristics, especially in times of such low interest rates and yields

- 6% Per Annum Coupon – 12% at the end is treated for capital gains tax (no tax if in a pension)

- 90% Loan-to-Value – which means you benefit from a 10% buffer in the value of the assets from the start

- Security – First Legal Charge over the Underlying Assets Backed by Government Contracts (25 years)

- Underlying Assets – Portfolio of residential units suitable for Social Housing

- Capital Gains Tax Treatment so first €1,270 / €2,540 of gains tax free

- Low Minimum of Investment Amount of €10,000