Is it too early to mention the C word? That’s right guys, like it or not, the time has come for you to start thinking about Christmas. It’s an expensive time of year but hopefully, we can help you get more bang for your buck after reading this blog. One iconic quote that really resonates with me about Christmas, is from George Best who said ” I spent a lot of money on booze, birds and fast cars. The rest I just squandered. ”

Make a list & check it twice

First off set yourself a limit to spend on each person, this will help to avoid impulse buying. Christmas budget planners are a great asset to plan and track all of your expenses. We always have the mindset of starting the New Year with a budget plan. To know how much it costs you to run you and your family. Any surplus goes to a saving plan to coincide with your goals and longer-term plans. If you have no plan, then even to plan for the season ahead will be a start – in this case, Christmas. Bundle all your costs, which is the total amount of money you are going to spend. If borrowing how are you going to repay? I will touch on this later when dealing with credit card debt. It is important to note how much you need and where you are getting it from if you haven’t saved it.

Never spend on impulse

Ok I’ll be the first to raise my hand and say that I have bought on impulse. But, please try stop yourself when you have an empty shopping trolley and you are wandering around aimlessly instead of sticking to a list… of course, you are going to be tempted that’s why you should never shop on impulse. If you have a list, you might be able to gauge what the total cost will be and just bring that amount of cash with you or do not exceed that amount on your debit or credit card…it takes discipline.

Credit cards are a big no no

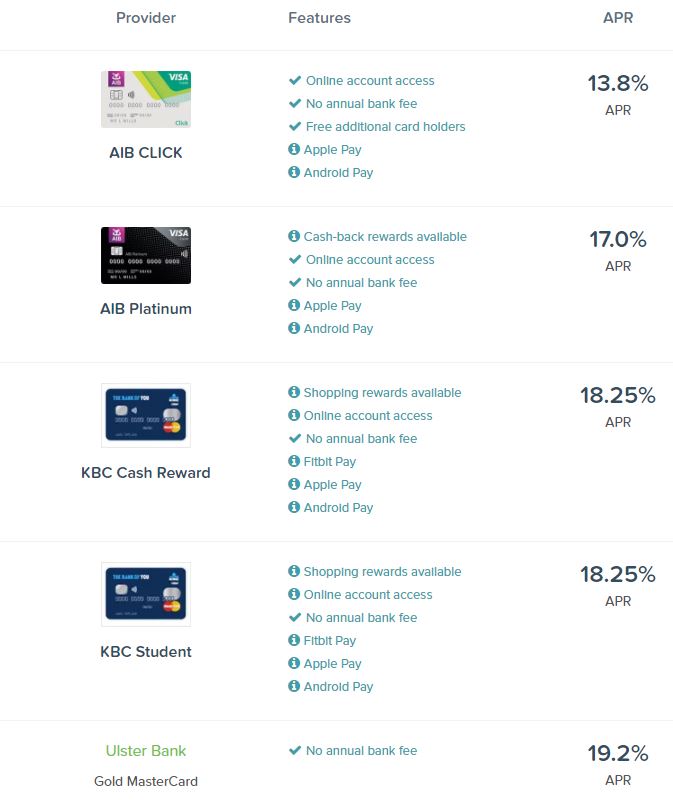

Credit cards are very expensive if you can’t repay them the debt in full immediately or within a few months. Pre-paid cards combine the convenience of a credit or debit card with the ability to allow you to set your spending limit according to your budget. Here’s a list of credit cards available in Ireland: you can see for yourself how high the interest rate is in each case.

Do you want to sign up for a loyalty card?

What’s the point of having a loyalty card if you never claim the points? Always avail of your points collected on loyalty cards and enjoy the benefits of using them towards paying for items. How often, do you find yourself forgetting at the till and remembering when you’re in the car. Be sure to take it out with your debit card when you are paying, so you don’t forget to add up those all important points.

Make sure you get your monies before the tax man does

Now is a good time to go to the Government website www.revenue.ie to check that you have been claiming all of the appropriate benefits and tax credits that are rightfully yours. Even though there was little change in the 2017 Budget it might have had a positive effect on your tax situation and you will be owed a tax refund which if applied for now will be payable in the a few weeks in the New Year, which is the time when you need it most.

Spend time with family & friends

While activity based traditions for the family during Christmas are important they don’t have to be expensive to be memorable. Over the festive season, there are many activities and events happening around the country which are inexpensive or even free. You can easily save money without skimping on those festive memories.

Start saving for Christmas 2018

Christmas will come round again next year so the earlier you start saving for Christmas 2018, the less you need to put aside each month. Even a small amount over a few months can make a big difference. Why not set up a standing order and transfer €50 per month into a savings account and by December next year you’ll have €650. We have a savings account when you can add anything from €100- €500 per month. This account is easily accessed and makes you monies work harder for you then it would in a bank account. At Alpha Wealth we’re ready to talk to anyone in relation to their personal finances right up till December 22nd.