Unless you have been hiding behind a rock for the past couple weeks, you would have noticed the coverage of the tracker mortgage scandal in the media. This is where banks have been accused of wrong doing to the public in relation to tracker mortgages taking out. I will run through a few questions that should help shed light on the area. The banks calculated that, even though they might lose money on these products, they could then “hook-in” the people who owned trackers and up-sell them more loans for cars, home improvements, and holidays, all of which would carry higher rates. The higher rates for other loans would off-set the losses on trackers and the banks got sneaky and reacted in the way they always do which is to screw the customer for the banker’s own mistakes and miscalculations.

Could you have been caught up in the tracker mortgage scandal?

Possibly. If you were ever on a tracker and were taken off it. No matter what the reason for this change, you could be one of 13,000 accounts to date affected, although that is by no means certain.

How would I know?

It is known that the banks are committed to going through their loan books to find all those who were affected. They were ordered by the Central Bank to make contact with those customers affected. Unfortunately, not everyone who was incorrectly denied a tracker has been contacted, and the banks and the Central Bank are still disagreeing over some accounts that the regulator considers were affected notwithstanding claims to the contrary by some banks. And guess what there are many thousands more have been affected. Add a healthy figure onto the13, 000 or so that are currently in the system.et

So do I just have to wait until the Central Bank process is over?

Right now the Central Bank is “the only game in town”, keeping updated by reading the various media outlets will help assure you of what is happening.

Facts to date

- €163m paid to customers in refunds and compensation a ‘fraction’ of money owed

- Customers will ultimately foot bill for tracker scandal

- Full extent of tracker scandal remains unclear

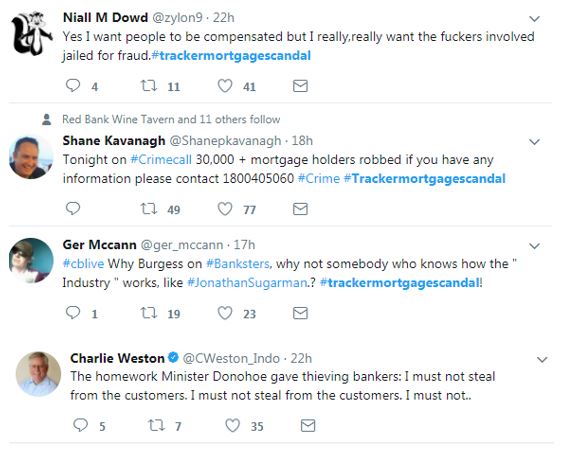

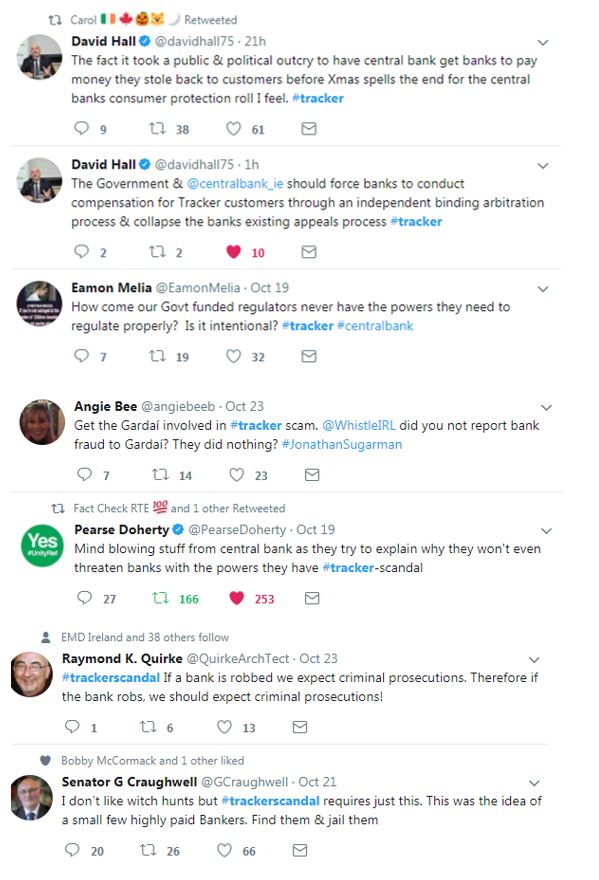

What has twitter got to say?

The big question ever has is should I take a legal action against my bank myself?

You could and by all means, you should do this. The legal avenue is open to anyone who considers they have been wronged. Unfortunately, this process is slow and very expensive. And many of those worst affected simply do not have the financial resources to take a High Court action, which is why the best advice is still to wait for the process to end.

When will it end?

It is progressing very slowly. This all started in 2015. Some banks have been proactive in dealing with cases; AIB and PTSB have dealt with a significant number of cases already. Ulster Bank have started to move. Bank of Ireland and KBC, on the other hand, have been very slow off the mark.

You will have some entitlements if you have been adversely affected by the bank’s misconduct.

- You will have to have the tracker restored.

- All the interest you overpaid will have to be repaid to you – or used pay off the mortgage.

- You will be entitled to compensation. (This will be decided by the bank initially and the Central Bank will review to see if this figure is suitable, the Central Bank is demanding the banks do more).

How do you fix it?

It seems that the whole issue is wrapped up by an industry who views success in the short-term, quarterly-results with which our global financial system has become obsessed.

The problem is the core culture that exists within these financial institutions. One has to ask themselves is it too much to demand a certain morality in the boardroom? Is it too much to ask for a few good men and women who apply morality to their business life? If not, we are in a troubling Ireland.