Currently in Ireland we have almost “The Perfect Storm” for Savers. Firstly, we have a situation of very low interest rates affecting the returns we get from our savings. Secondly, we have one of the highest Tax rates on deposits, which is currently 39% of the interest you earn. If you add to this the rising costs of buying a property or putting your child/children through school, then you get “The Perfect Storm” or treble whammy.

There are a whole generation of people aged between 25-40 who are struggling to save enough, whether this is for a deposit to buy a house, their children’s education funds, the holiday of their dreams or their pension pot at retirement. The cost of putting just one child through school can easily run into tens of thousands of euro. If you have two or more children then you’re going to have to dig even deeper to sustain the cost of their educational needs over the long-term. According to a Zurich life survey (2017) the cost of Primary school education is €766 per year. When it comes to secondary school, costs increase greatly at €1,629 per annum. College doesn’t come cheap either and by the time a teenager reaches third level, parents are really feeling the cost of putting their children through university or college with an annual cost varying between €4,300 p.a. to €8,600 per annum depending on whether they are living at home or not.

Also, to make things worse the Bank savings rates have progressively falling over the last 12-18 months. The best rates are online but are now down to 3% gross per annum, but once you factor in DIRT (deposit interest retention tax) at 39% this works out at 1.83% p.a. net. However, for most of us with our money is in current accounts in the Banks and we earn nothing. The Credit Union dividends aren’t much better at interest of less than 0.5%. The Post Office savings, whilst Tax free, have also been cut drastically with their 3 year savings account paying 1% over the full 3 years (0.33% per annum) and their 10 year bond paying 16% (1.6% p.a.)

So what can Joe Public do?

Well firstly, there are Savings plans through some of the life assurance companies (especially over the medium/long term) that would typically generate returns of 5% p.a. plus. These are certainly attractive in this low interest rate climate. By even saving €50 p.m. with the difference of 1% p.a. interest versus a 5% p.a. interest, this would give a difference in savings of €2,079.52 over 5 years and €8,428.55 over 10 years.

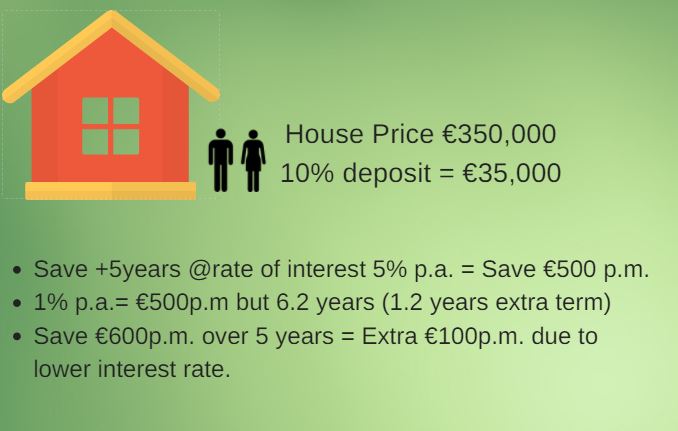

Take a couple who are first time buyers saving for a house costing €350,000. They will require a 10% deposit, that is €35,000. So if they were saving over 5 years, at a rate of interest of 5% per annum on their savings, they would have to save €500 p.m. At 1% per annum interest they would have to save €500p.m. over 6.2 years so adding another 1.2 years to the term by which they must save. Alternatively they would have to save €600 p.m. over this 5 year period, so an extra €100 per month due to the lower rate of interest earned. (see below)

The other way to increase returns is to shop around. The variation in bank rates is huge and the gap is widening. There are some good sites to help people find the best rates such as www.bonkers.ie. Whilst we are becoming savvy, Irish consumers are still suffering from lethargy when it comes to shopping around and according to a Central Bank survey earlier this year, only 0.06% of us in 2016 changed our accounts to reduce fees or improve our returns. Within Irish society, there is still a perception that there is a lot of time and hassle in changing accounts. Banks are making this easier, both with online banking and also since 2010, all credit institutions providing current accounts in Ireland are subject to the Switching Code. This code was introduced by the Central Bank in October 2010. Its purpose is to make the process of switching current accounts easier. The Switching Code sets out mandatory procedures that must be followed by credit institutions when a consumer decides to switch their current account from one credit institution to another.

Consumers shouldn’t lose complete hope however as there are some tailwinds. Tax rates are improving, DIRT has been reduced from 41% in 2016 by 2% each year over the next 4 years to 33%. Also analysts are forecasting an interest rate rise will take place at some point in 2019 at the latest. My advice to savers is to be diligent and frugal ensuring you are not passing up opportunities through any sense of loyalty and educate yourselves to what is on offer.