Taking out a mortgage in Ireland can be stressful. From trying to get your head around a whole new set of terminology; to finding a broker and the right lender; to deciding on what kind of mortgage rate is most suitable for your financial situation… the list goes on. It’s no wonder that we’re reluctant to revisit our mortgage repayment situation once everything has been settled and put into place.

Though it might seem like an unappealing prospect, now is the perfect time to look into switching mortgage providers. Rates are finally starting to fall and switching could end up saving you a lot of money in the long run.

Why should you switch mortgage lenders?

The thought of switching mortgages might seem daunting but according to Nick Charalambous of Alpha Wealth, “switching has never been easier”. Currently, switching rates are quite low. A recent study by the Central Bank revealed that consumers haven’t switched because they think it would be too complex. However, 81% of those surveyed who have gone through the switching process report that they fully understood each and every step of the process.

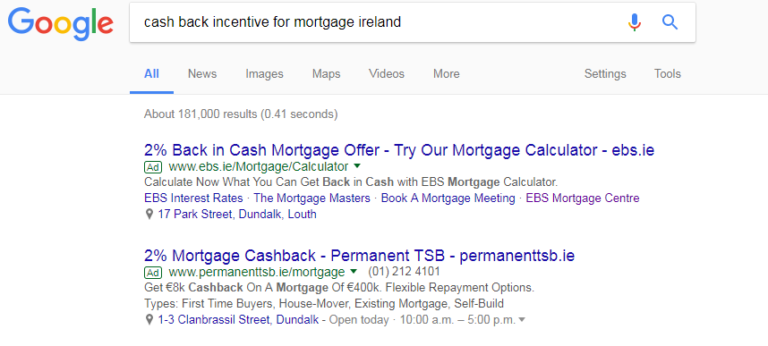

Mortgage Switchers are offered substantial cashback incentives

The number of borrowers switching mortgages has been increasing and this could be partly due to the various cashback incentives offered by many mortgage lenders. Googling the term will tell you everything you need to know.

AIB is currently offering €2,000 in cash to anyone who switches their mortgage to the bank.

KBC is offering €3,000 towards legal fees, and Ulster Bank is offering €1,500.

Permanent TSB is offering 2% of the full mortgage amount in cash to switchers, and Bank of Ireland is offering 3% (but you must be a current account holder to take full advantage of this offer).

So, what do these incentives translate to? Let’s take a look at an example using the Bank of Ireland’s incentive:

A borrower with €200,000 outstanding on their mortgage will get a €6,000 in cash from the bank for switching. And a borrower with €300,000 outstanding will get €9,000. The cash is paid in two chunks; the first 2% at the time of switching and the remaining 1% after five years.

How to Switch Mortgages in Ireland

The next big question is, how do you switch mortgages? What is the process?

The first thing you should do to get the ball rolling is to check if switching is actually going to save you any money. If you’re on a tracker rate, for example, there would be little point in switching.

The best and easiest way to check if you would save money is to contact us at 021 206 1780 or email info@alphawealth.

Once you’ve done that we can help you identify the lender that you want to switch to and help you to save money on your mortgage.

Financial Advisors 7 Tips on Switching Mortgages:

- Make sure you’re switching to a lender that offers you better long-term value. Some of the cheapest rates out there are available to people borrowing less than between 60% and 80% of the value of their home. It may be the case that when you decide to switch your home could be worth more than when you first took out the mortgage, which means you could qualify for cheaper rates. Don’t forget, if you’re on a fixed-rate mortgage, you could be hit with penalty fees if you switch lenders before the fixed term is up.

- Make sure that you are eligible to switch to your chosen bank. They are unlikely to take you on if you are in mortgage arrears or negative equity. Like with any loan, you need to be able to prove that you can repay the money you owe. We strongly recommend years previous to getting a mortgage to start a savings plan where you can set out an allotment a month and reap the rewards of a much higher return than the interest rates set in the bank.

- Prepare all of the relevant documentation. You’ll need pay slips, P60, current account statements, mortgage account statements, and proof of address and ID.

- Fill out the mortgage switcher application form from the bank you want to move to.

- Have your home valued – the bank you are moving to will require an up-to-date valuation of your property. We also have an advisor in this space in Cork who is very reasonable.

- Ensure that your home insurance and mortgage protection insurance are in order for your new loan. We won’t be beaten on price as a low-cost broker we ensure that we get the cheapest price but also a suitable plan for the client’s needs. Depending on your circumstances we can best advise you what you will and won’t need.