If you are a young person should you be worrying about your pension? The quick answer is – no. As an alternative to worrying, which solves nothing and causes bad health anyway, Millennials should plan.

In my opinion, pensions are mostly thought of as a “savings plan for older people” but in reality, they are a young person’s game. However, because so much of the language that is used to describe and explain pensions is confusing, jargon-based. Pensions can be a turn-off to the very people that really do need to know what they are, how they work and how they can offer real benefits.

Why Your Pension matters

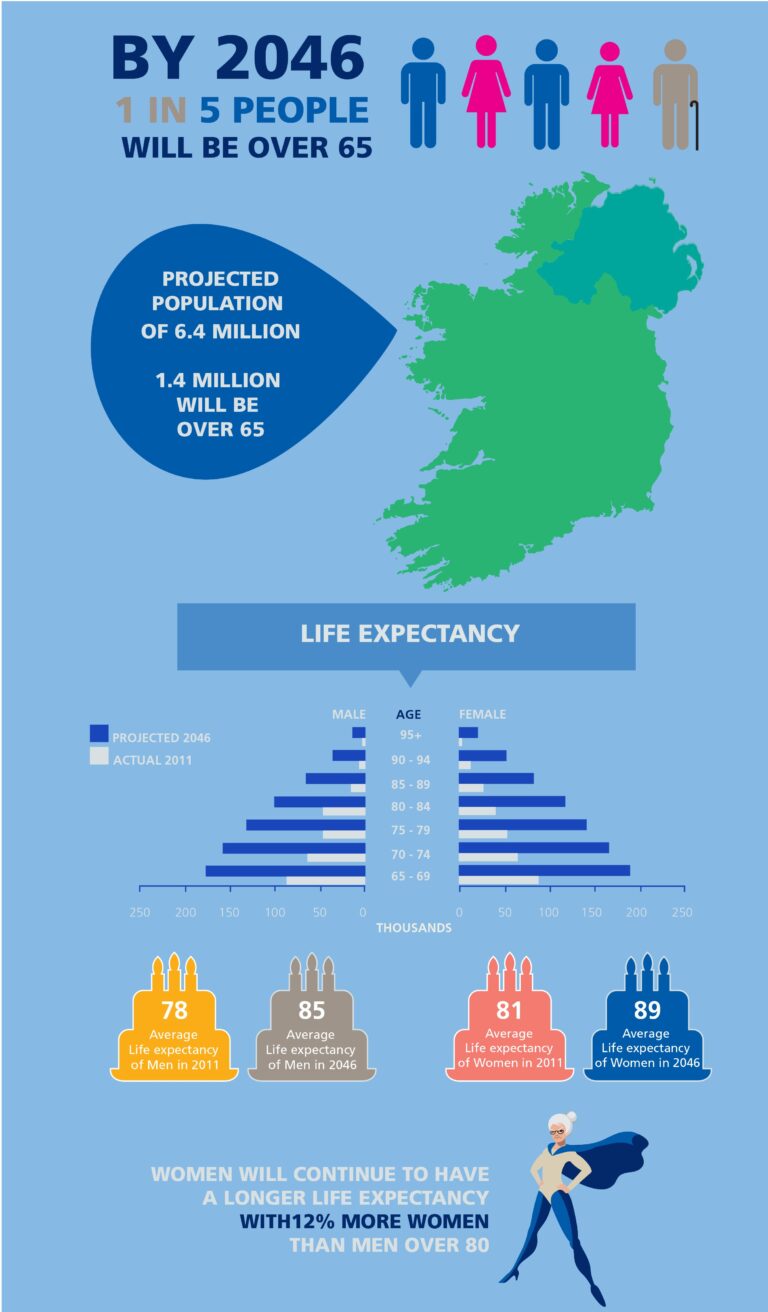

Simply put, to begin with, experts predict that people will all live longer. Whether it is as a result of taking better care of our bodies, advances in medical research or innovations in pharmaceuticals, people are living longer at current rates. What used to be a retirement age of 65 has been increased and may move higher still?

Why such bad news

On the face of it, the pension’s landscape looks fairly dismal. But all is not lost. The earlier point that pensions are a young person’s game is still true. Today, it is possible to grow personal wealth faster and more efficiently than ever before and – if one knows how to play the game – end up with a final pension pot that can be extremely generous indeed.

Taking Advantage of Pension Schemes

The Government still gives back your tax if you put it into a pension (it is scaled to between 15% of salary and 40% of salary up the €115,000 threshold). That is called tax relief. So how does your money grow? The stock market grows at an average rate of about 6% each year. Some years it crashes and more years, it booms, but on average, it sticks to that rate of growth. Pensions have peaks and troughs but, looking at the big picture, they are still better for securing your future. The average managed fund over the past 30 years has returned about 9% per year. The best post office tax-free returns offer 5% per year.

Financial Planning for Your Future

Our public pension system, which is already severely challenged, will be put under even more stress in coming years. If more and more of us are displaced by robots there will be even fewer contributions paid into the state’s pension pot in the future. And, as more and more of us live longer, we will be drawing down the state pension for far longer in the future.

If you can invest money in your mid-20s, over time and because of time, the rate of growth compounds. In other words, growth builds on growth and the earlier you put your money in, the greater the chance that when you are older, you can actually take your foot off the investing pedal and leave the stock market to do the work, making your money grow. It’s not like Vegas gambling your money. Of course, as you move up the age ladder, you will need to adjust the level of risk your money is exposed to, but there is a formula for this.

Tax Relief

The reward for someone aged 35 that earns €50,000 per year, put 10% of their income into a pension, where half is matched by their employer, factoring for tax relief, wage and economic inflation, average money growth of 6%, yield over €250,000 more for that person by age 70.

A sharp fall in pension coverage is cause for concern for all of us because the increase in reliance on the State pension will place even more pressure on already strained resources due to an ageing population whose life expectancy is increasing.

Our Financial Advice

In order to secure a financial future, starting a pension is one of the smartest financial decisions you can make. When choosing a pension, having all the information you need is key. Sound advice is invaluable, so it’s a good idea to seek advice from a financial broker or advisor. They can guide you through the process and help you select the right plan for your circumstances.

You can find us a little island, Cork or alternatively contact us at 021 206 1780 for financial advice about finding the right pension plan.