What comes to mind when you think of diversifying?

Everyone knows the old cliché about not putting all your eggs in one basket. A diversified portfolio might consist of different asset classes such as bonds, property and commodities, but what about equities? Exactly how many stocks are enough? Can you be too diversified, or should you aim to hold as many stocks as possible? Even novice investors can grasp the simple logic underpinning the case for diversification. An individual stock may easily fall by 50 per cent or more in a short space of time, but a portfolio consisting of dozens of stocks is much less likely to do so.

Equities

Equities, also known as shares, give part ownership in a company. They provide investors with exposure to the success or failure of those companies. Equity exposure can be allocated across sectors, regions or mixed. Regional exposure can be to stock markets in developed markets such as North America and Europe and also emerging markets.

Bonds

Bonds are loans issued by governments and companies. Bond exposure can be allocated to government bonds, high quality corporate bonds, high yield bonds and debt, inflation linked bonds, asset-backed securities and emerging market debt. Prize Bonds are Government securities (a joint venture with an Post and Fexco) which, instead of attracting interest, participate in draws for weekly cash prizes.

Property

Property investments relate to commercial property. Direct property exposure involves the investment in physical commercial buildings such as office blocks and shopping centres. Indirect property exposure is obtained by investing in property funds and property shares.

Consumers can cluster todays this element of their portfolio as they have an attachment towards a tangible product.

Alternatives

Alternative investments provide additional diversification benefits. Examples of alternatives could include commodities such as oil and gas. Other examples of alternatives include hedge funds and private equity.

There has always been the age old question: what is the most profitable investment in the world?

As the stock market has produced the highest returns over the medium to long term it makes sense to put a large percentage of your capital into shares. You can so this via pooled investments, index or tracker funds or by choosing individual shares yourself. Whatever route you choose you if you mirror past performance you can look forward to some pretty significant profits. For instance, the average return in the Irish stock market from 1974 up to 2006, was 17.4%. OK it has been a bit of a roller coaster since then, but we are still in the 3rd (soon to be 2nd longest on 30th April) Bull market in the history of the stock market – up over 200% since March 2009.

These figures relate, of course, to the average annual return. Some investors will have done better than the market, others less well. The key point is, however, that with planning and patience – especially the latter with the recent hiccups in the ISEQ – the stock market represents an incredible money making opportunity. Look at managed funds – simple to understand and easy to operate. Two names to watch out for –

Irish Life Multi Asset Portfolio (MAPS)

**Source Irish Life

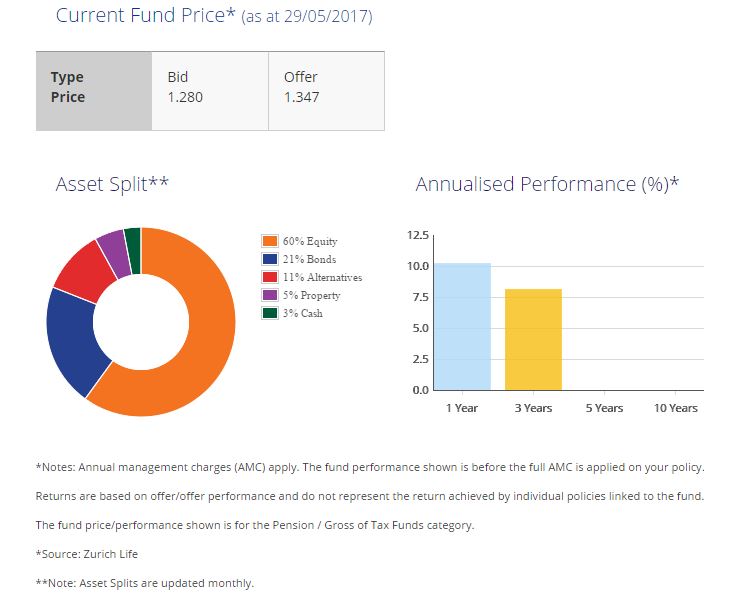

Zurich’s Pathway funds

Applying what I have been discussing here is an example of an actively managed fund with a risk rating of 4 which is considered to be medium risk. The fund gives the investor many different asset classes and its primary aim was to meet its risk target of a rolling five year volatility between 5- 10% per year.

Aviva Multi Asset fund

**Source Aviva Investors

If you would like to discuss any of these ideas with me, I am only an email away (nick@alphawealth.ie) . Remember, you should always take professional advice before making any financial decision.

Disclaimer– Alpha Wealth is in no way bias towards any products of the Irish financial services providers, this is an opinion piece. Date of publication 30/05/2017. All information is accurate to this date in time. We have used a risk rating of ‘4’ in the examples above.