Being a student is tough financially. It means more freedom and more responsibility in terms of your studies, and also in terms of managing your money. College life can be expensive if you allow it to be, but with good sensible budgeting practices, you can help keep your finances under control and your expenses to a minimum. In this post, we will be sharing some financial tips and advice to save during your time as a student.

As a twenty-three-year-old recent college graduate, I understand the importance of managing finances for the duration of your stay in college. Starting college, and indeed continuing your college career, is an exciting time in your life – leaving home, meeting new people, experiencing new things and furthering your education.

- Build your Budget

- How to Manage Student Fees

- Save Money Using a Student Leap Card

- Save Money and Spend Efficiently

- Stay Away from Expensive Bad Habits

- Don’t Over-Spend

- Financial Advice for Students

Build your Budget

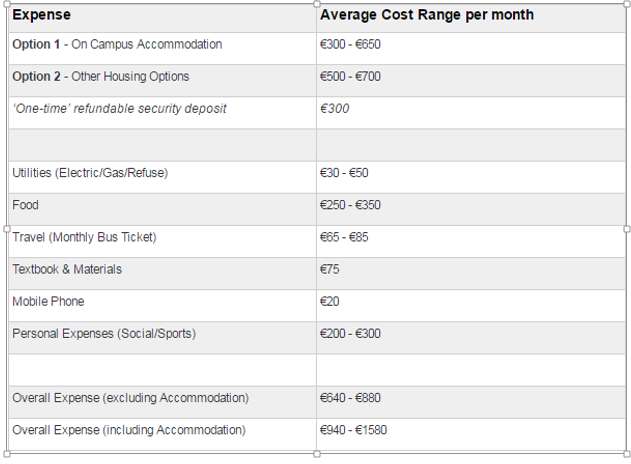

Devising a clever budget at the start of the college year and sticking to it will ensure you keep stress and money-related anxiety at bay, especially in the run-up to exams. Cost of living may vary greatly according to your lifestyle and choices. It is best to work out what your estimated income and expenditure will be and budget accordingly. Please note the following approximate figures serve as a guide only.

How to Manage Student Fees

There are student financial assistance schemes available to help students pay their fees. To check if you qualify for assistance check out: http://www.studentfinance.ie/

Save Money Using a Student Leap Card

The Student Leap Card is the official student lifestyle card for travel, entertainment and retail discounts across Ireland. The card offers over 100 discounts covering big brands such as Irish Rail, Bus Éireann, Topshop, McDonalds, Costa Coffee, etc. You can even get discounted rates to GAA matches through the card! The card costs €15.00 through card agents which are usually on campus. Log on to www.studentleapcard.ie for more details.

Save Money and Spend Efficiently

Beans on toast 24/7? It doesn’t have to be!

Use markets to buy cheap vegetables and fruit, buy own-brand labels in the big stores, buy a decent cookbook in the sale, or at a second-hand shop, and get staples like rice in bulk and you can eat well for €30 a week.

Make your own sandwiches, refill your water or juice bottle.

Stay Away from Expensive Bad Habits

Don’t smoke! Obviously, it is bad for your health and is very expensive.

A 20-a-day habit will cost you €10.00 per day, €70.00 per week, €280.00 per month and that’s whopping €3360.00 per year.

When you consider that currently, the standard 100% maintenance rate is €3025, you need to ask yourself: can I really afford to smoke?

Cut back or ideally give up. Either way, it is better for your pocket and for your health.

Don’t Over-Spend

Expensive electronics, going out with your friends and eating out multiple times a week are likely going to become a thing of the past. Make sure that you are meeting your financial obligations before you start to spend on frivolous items that aren’t necessary for your survival.

Remember, college is probably going to be a time of your life when you make very little money, so you had better be prepared to make some sacrifices.

Financial Advice for Students

If you are having money worries, look for help as soon as possible. If you are having problems making repayments on a loan or credit card, contact your provider to explain your situation. Whatever you do, don’t ignore the problem. Missed repayments could affect your credit history and could mean difficulty getting loans in the future.

Finally, don’t forget, for great advice on money management and how to plan for your financial future, you can avail of our complimentary expert advice today! Click here to make an appointment https://alphawealth.ie/contact/ or call us on (021) 2061783